crypto tax calculator australia free

Find the highest rated Crypto Tax software in Australia pricing reviews free demos trials and more. The Australian Tax Office classifies cryptocurrency as a property or a capital gains tax asset.

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Australian Tax Office Targets Cryptocurrency Investors.

. Crypto Tax Calculator Australia offers package deals with SMSF Accountants or accounting firms as a whole. Check out our free guide on crypto taxes in New Zealand. To use a crypto tax calculator you should understand the basics of how crypto tax is.

How is crypto tax calculated in Australia. The cryptocurrency tax calculator provides users with an estimate of the capital gains tax incurred when a cryptocurrency asset is sold traded or otherwise disposed of. Straightforward UI which you get your crypto taxes done in seconds at no cost.

Or Sign In with Email. Crypto tax calculators are used by crypto enthusiasts all over the world to help automate their crypto and bitcoin tax reporting. SUBX FINANCE LAB is a blockchain-as-a-service provider fast-rising in Singapore.

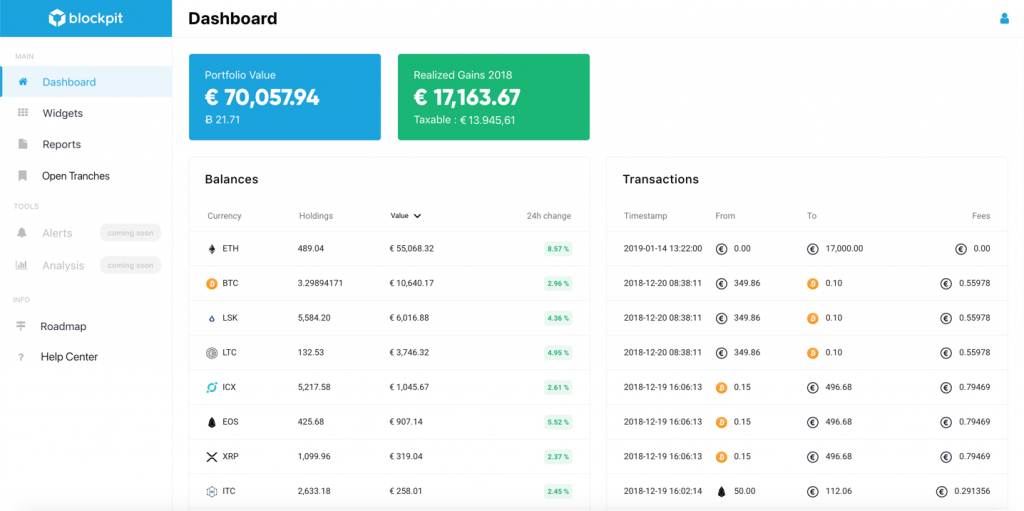

Following is a handpicked list of Top Crypto Tax Software with their popular features key statistics pros and cons and website links. It provides the most accounting transparency of any cryptocurrency tax calculator. Online Crypto Tax Calculator with support for over 400 integrations.

The tax report that CoinTrackinginfo gives you all the information you need to do your tax no matter where you reside. Koinly can generate the right crypto tax reports for you. The Enterprise plan will cost you 249 and cover 60M AUM.

Just make sure to import all relevant transactions and the. For example Australias ATO Australian Tax Office the UKs HMRC Her Majestys Revenue and Customs both use different tax metrics. 49 for all financial years.

Other countries have similar rules for filing crypto taxes but differences do exist. As with most other countries Australians calculate their taxes owed based on the fiat value of the crypto at the time of the transaction. Get started today and maximize your refund.

The list contains open-source free and commercial paid software. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

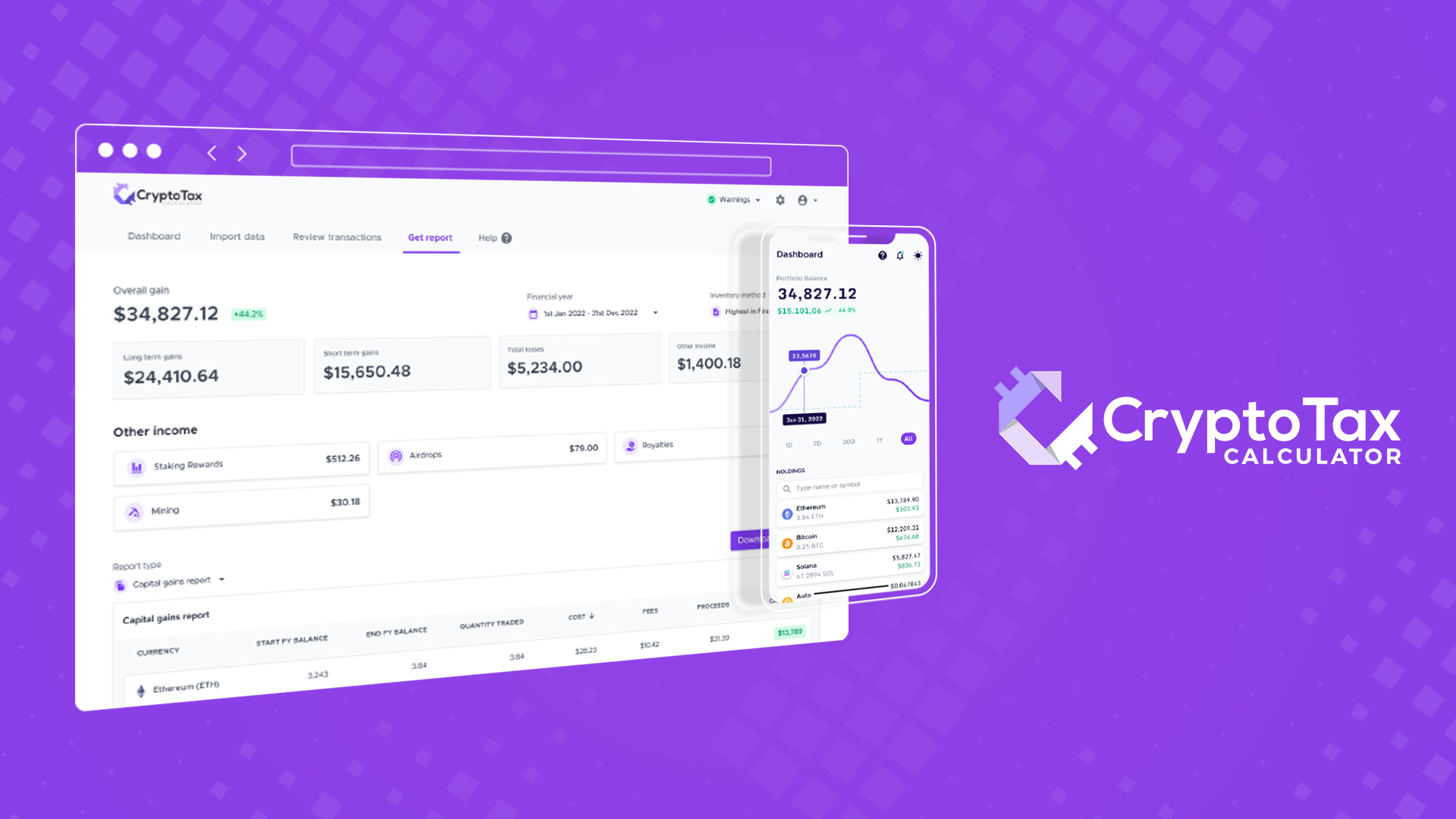

If you are filing in the US Koinly can generate filled-in IRS tax forms. 8500 upfront for 50 reports and 185 per report thereafter. As Tim Brunette co-founder of Crypto Tax Calculator an Australian startup that has leapt up in the crypto-adjacent space recently told DMARGE crypto is gaining greater cultural purchase.

Sign In with Google. The business plan comes at 99 per month and covers 10K taxations and 20 million in assets. Get Started For Free.

Compare the best Crypto Tax software in Australia of 2022 for your business. Download your tax documents. Get help with your crypto tax reports.

Whether you are filing yourself using a tax software like TurboTax or working with an accountant. In order to use the cryptocurrency tax calculator effectively youll need to provide a number of specific details about the cryptocurrency asset you have. Every transaction can be adjusted or tailored using the Grand Unified Accounting GUA spreadsheet to fit the investors best possible tax outcome using their preferred accounting method.

200 per report payment upfront by credit card or direct debit. Calculate and report your crypto tax for free now. Crypto taxpayers can use the libra tax calculator for free for up to 500 transactions while the paid subscription allows them to track 5000.

Crypto Tax Calculator Australia Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. Online Crypto Tax Calculator with support for over 400 integrations. There are cloud-hosting tools specifically designed for crypto miners.

See our 500 reviews on. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. Form 8949 Schedule D.

The Fastest and Easiest Crypto Tax Calculator Join over 200000 crypto investors calculating their profits losses and tax liabilities with CryptoTraderTax today. Using The Australian Cryptocurrency Tax Calculator. ZenLedger is much more than just a free crypto tax calculator.

Discover how much taxes you may owe in 2021. Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance. No expiry date on the use of the first 50 reports.

If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional trader. Miningstaking Income report. Blox free Pro plan costs 50K AUM and covers 100 transactions.

Crypto tax software also helps you calculate and file your crypto taxes easily. Best Cryptocurrency Tax Calculator.

![]()

Cointracking Crypto Tax Calculator

Best Crypto Tax Software 10 Best Solutions For 2022

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Free Crypto Tax Calculator 2022 Online Tool Haru

Malta Based Stasis Launches New Euro Backed Stablecoin Bitcoin Bitcoin Price Euro

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

Crypto Tax In Australia The Definitive 2021 2022 Guide

Crypto Tax In Australia The Definitive 2021 2022 Guide

Australia Crypto Tax Guide 2022 Koinly

Calculate Your Crypto Taxes With Ease Koinly

How To Calculate Crypto Taxes Koinly

![]()

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Koinly Crypto Tax Calculator For Australia Nz

Bitcoin Price Prediction Today Usd Authentic For 2025

Australia S Cryptotaxcalculator Helps Traders Demystify The Decentralized Techcrunch

![]()

Cointracking Crypto Tax Calculator

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger